Build Wealth. Build Confidence.

A Fixed Income Fund That Pays You Monthly Returns and Protects the Next Generation

Our Approach to Building Wealth

Broad Diversification

Our capital is spread across various properties and regions to reduce exposure and strengthen overall performance.

Strategic Deal Sourcing

We fund well-vetted, asset-secured projects with strong upside and responsible exit strategies.

Risk-First Strategy

We use leverage thoughtfully — always with investor protection and fund resilience as top priorities.

Clear Communication

We believe investors deserve to know what’s happening — so we provide timely, transparent updates you can rely on.

Built for Stability

We’ve designed a straightforward investment model focused on consistent growth, security, and peace of mind.

Aligned Interest

We invest alongside our partners — so your success is our success. We only win when our investors do.

Our Mission: Secure Your Future. Strengthen Theirs.

Earn Passive Fixed Monthly Returns While Empowering Kids to Stand Tall

Empower Kids

We invest in programs that teach children how to stand up to bullies, defend themselves, and speak with confidence.

Build Confidence

Confidence is the foundation of resilience. We support initiatives that help kids develop inner strength through leadership, mentorship, and self-worth.

Stop Bullying

Our mission directly supports anti-bullying campaigns in schools and communities. We believe every child deserves a safe and supportive environment to grow.

Educate for Safety

We fund workshops and programs that teach kids how to stay safe, avoid danger, and respond calmly to threats. Education is the first step in prevention.

Protect Futures

By giving children the confidence to defend themselves, we help protect their futures. Empowered kids grow into stronger, safer communities

1 Million Strong

Our bold goal: protect 1 million children from bullying and exploitation by 2030. When you invest, you're part of a movement much bigger than yourself.

Why Choose the Y2 Capital Group Fixed Income Fund

Investing with Y2 Capital Group means accessing a secure, steady, and truly passive income stream — all backed by a proven strategy and real estate expertise.

-

10% Target Annual Return

Generate consistent income with a strong 10% annual return, designed to deliver financial peace of mind.

-

Hands-Free Passive Income

With multiple years of performance, we make passive investing simple, reliable, and repeatable.

-

Upside Through Value Creation

We focus on deals where smart improvements enhance asset value — boosting overall performance.

-

Monthly Cash Flow

Enjoy dependable monthly distributions that help support your lifestyle or reinvestment strategy.

-

Accessible Entry Point

Start building your portfolio with a $50,000 minimum — no need for large upfront commitments.

-

Real Estate-Backed Stability

Our debt-focused approach gives you built-in diversification and downside protection through asset-backed lending

Outperform Traditional Investments Without the Rollercoaster

Our Fixed Income Fund offers 10% target returns with lower volatility than stocks and more upside then bonds or CDs.

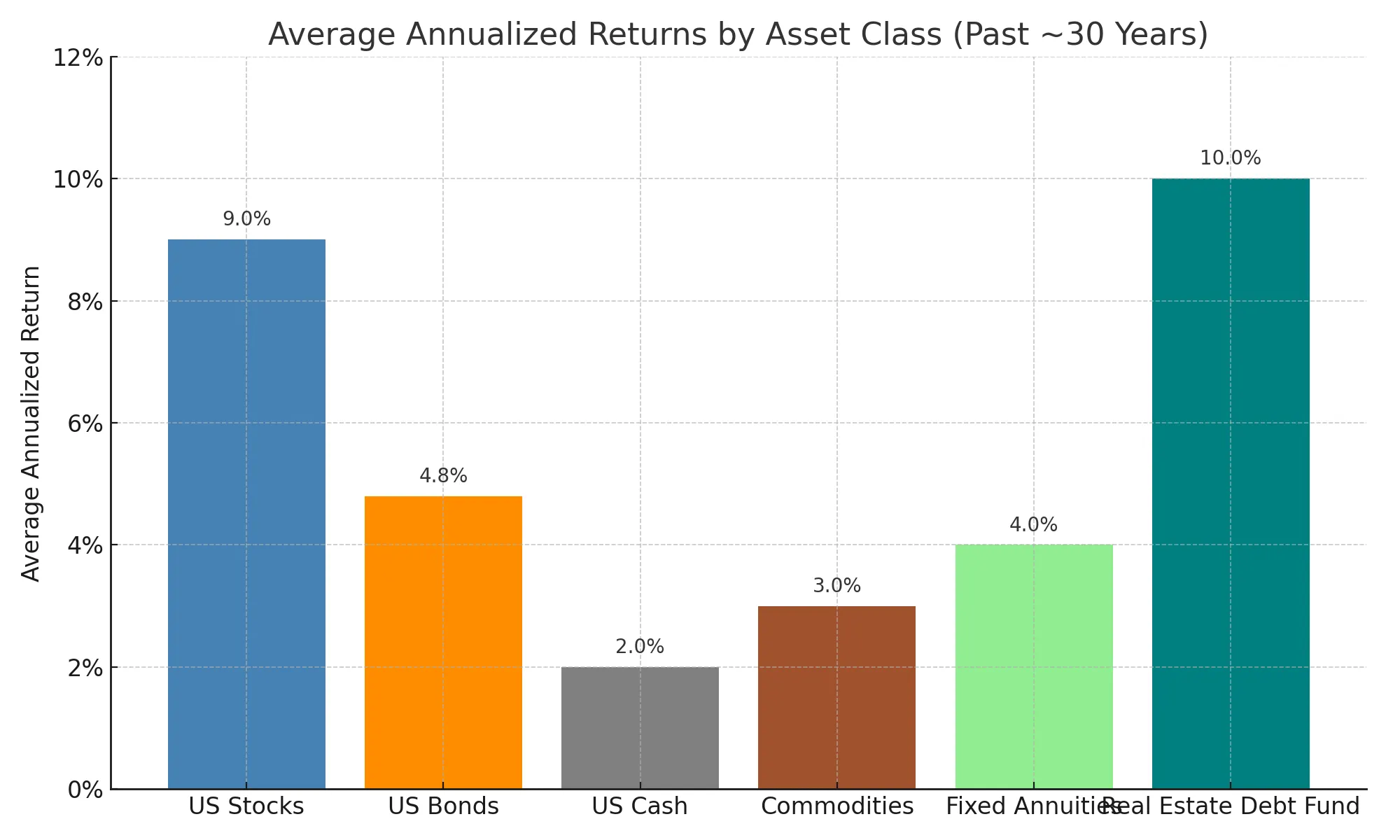

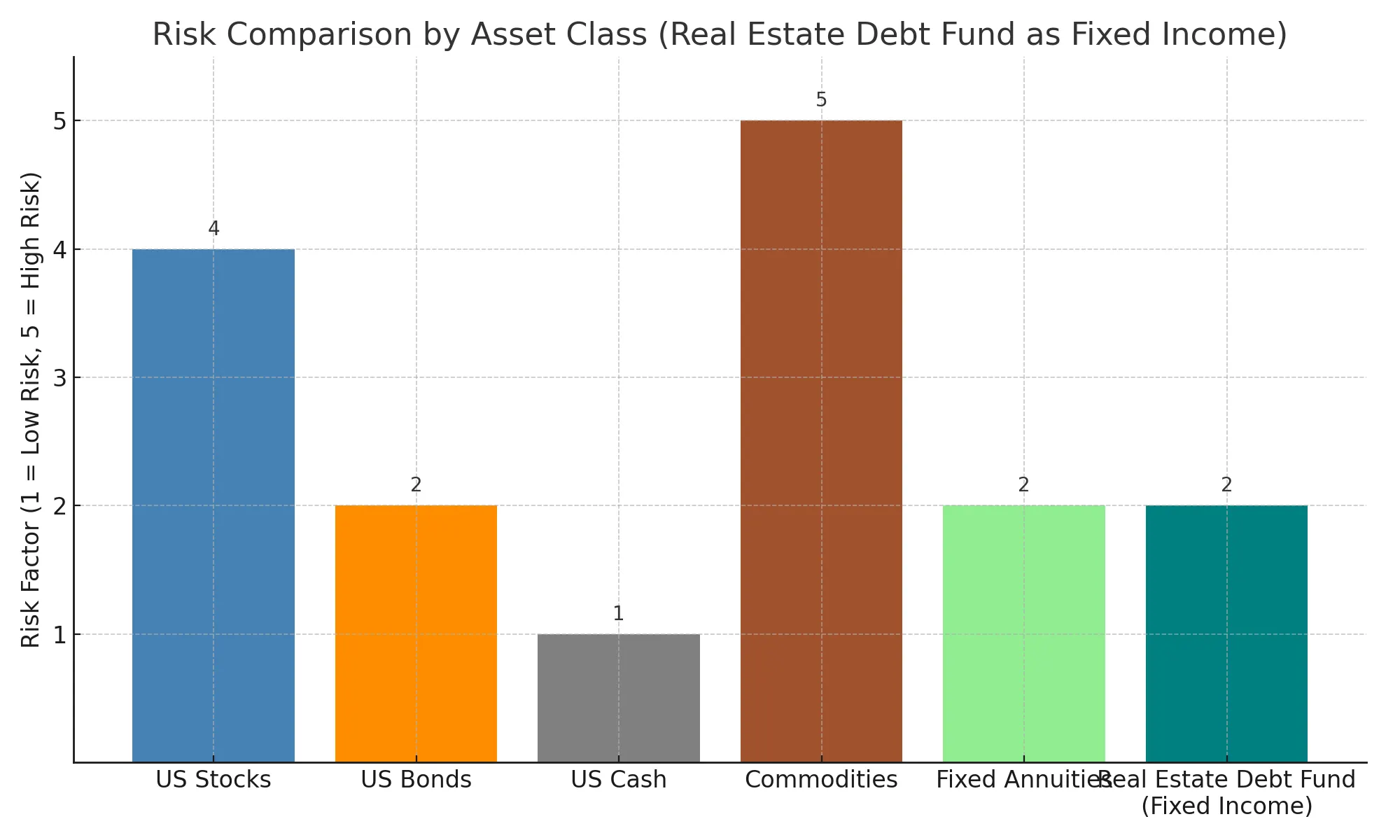

1. Fixed Income Fund vs Traditional Investments

What makes this Real Estate Debt Fund particularly compelling is the combination of strong, consistent returns with a fixed-income profile. Unlike stocks, which are subject to market volatility, or commodities, which can be highly unpredictable, this Fund is a great alternative, especially attractive during times of economic uncertainty or inflation, that delivers high-yield double digits returns secured by real assets and delivers returns on a monthly bases.

In an era of market volatility and low bond yields, the Real Estate Debt Fund delivers a rare combination of predictable cash flow, capital preservation, and superior risk-adjusted returns—making it an ideal component in a diversified, income-focused portfolio.

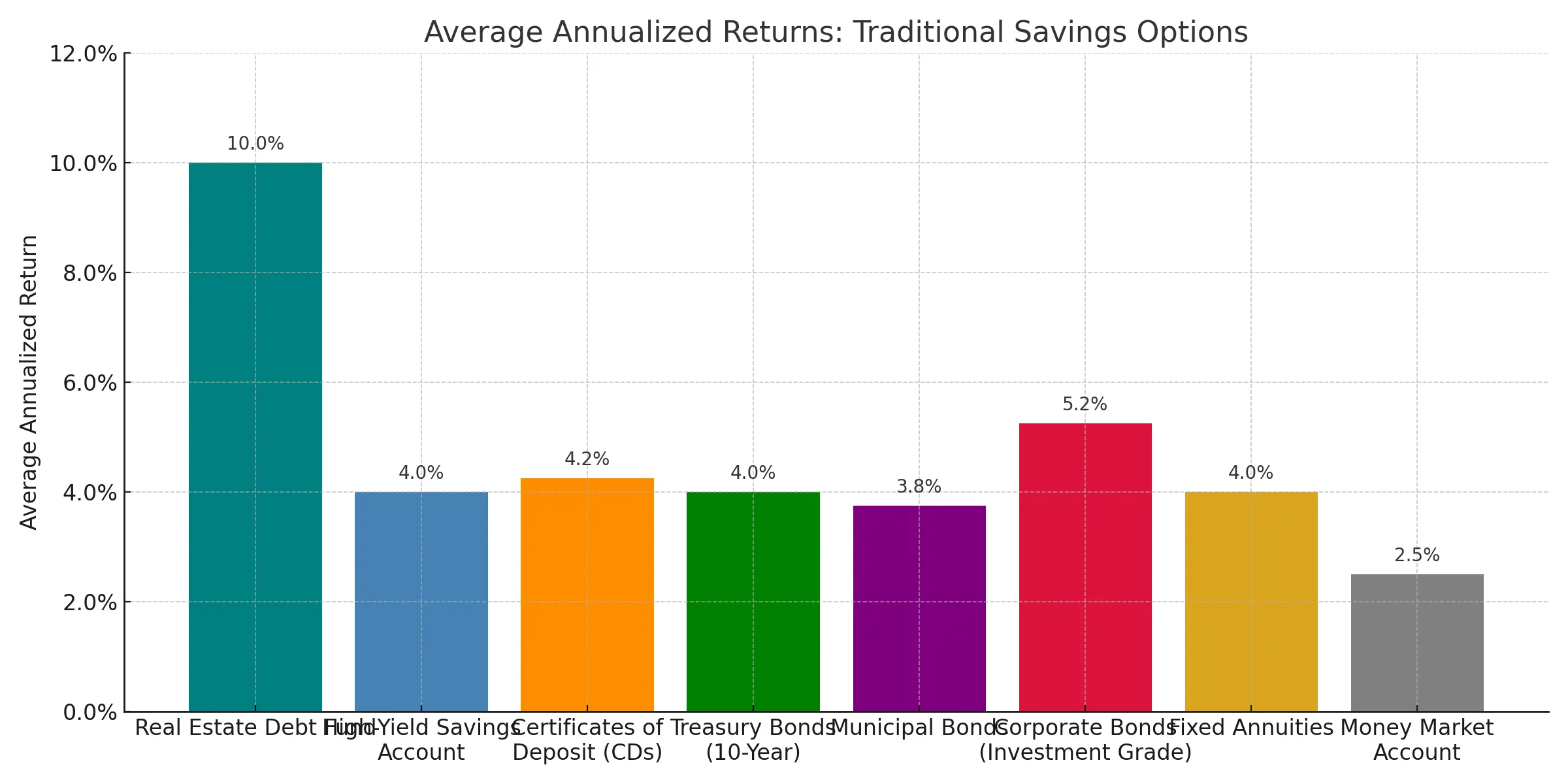

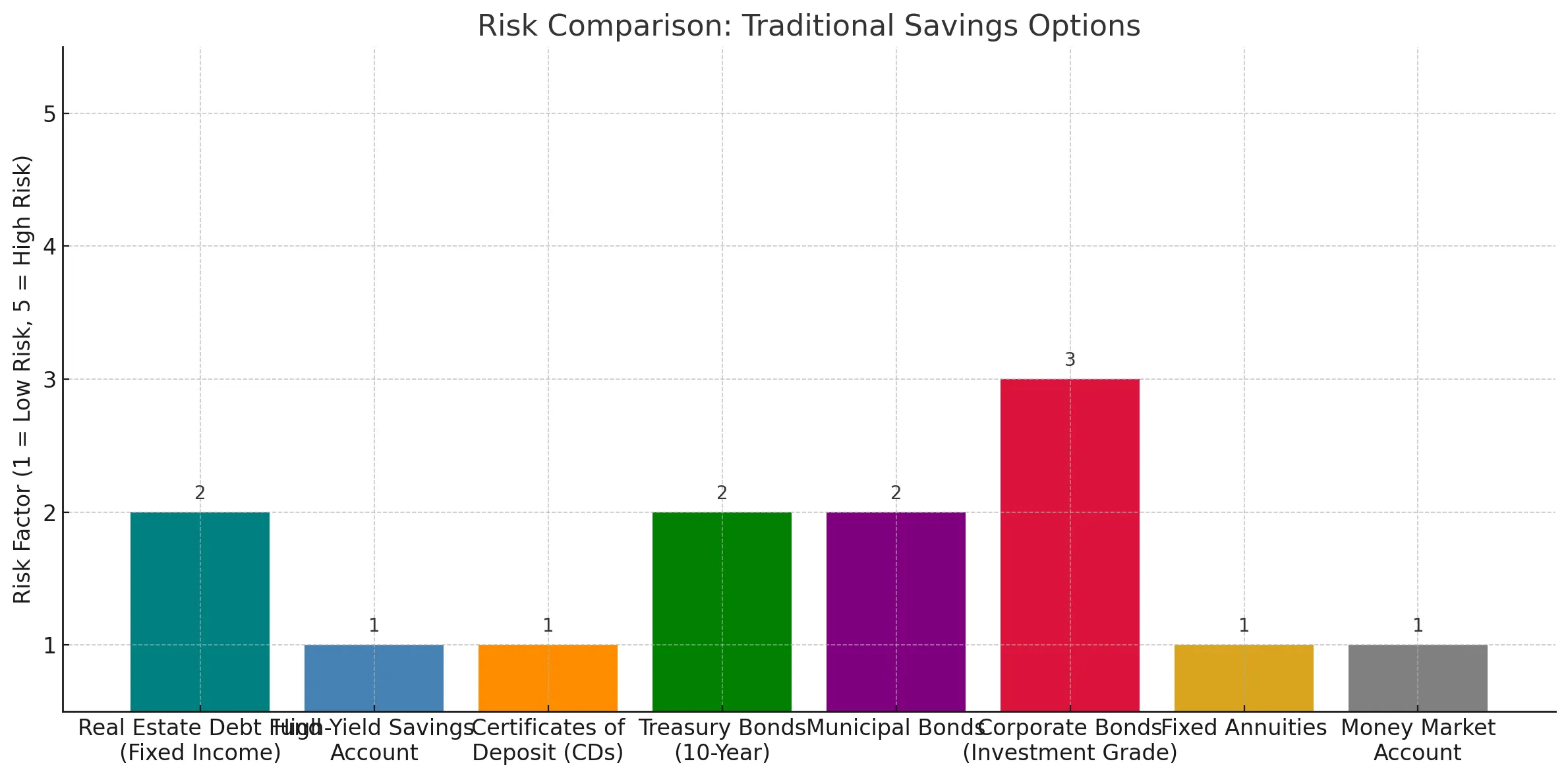

2. Fixed Income Fund vs Traditional Savings Options

For accredited investors looking to move beyond low-yield traditional savings vehicles, the Real Estate Debt Fund offers a strategic edge. With consistent annual returns of 10%, it dramatically outperforms savings accounts, CDs, money market funds, and even fixed annuities—all of which typically yield 2% to 4% annually.

Unlike these vehicles, which are designed primarily for liquidity and capital preservation, the Real Estate Debt Fund delivers both income and asset-backed security through loans collateralized by real estate. In a low-interest-rate environment, this fund provides the rare opportunity to maximize idle capital without assuming equity-level risk—making it an essential consideration for accredited investors seeking stable, high-yield alternatives to traditional savings options.

What Investors Say About Us

I have worked with Eugene as an investor and was very happy to be able to put my money to work while I was between multifamily deals. He was great to work with, had a great deal flow and delivered the returns on time. I highly recommend Eugene and his Fund.

Brenda G., Private Capital Investor

Eugene has been great to work with on every project. He is very communicative, easy to work with, and moves transactions through quickly. I would highly recommend partnering with him and his Fund on any funding projects, and will definitely work with him again.

Justin S., Private Capital Investor

Get access to a 10-min recorded webinar

Watch our 10-min recorded webinar that goes over our real estate debt fund and explains how our investors make money and stay protected at the same time.

We Love Attending & Meeting Remarkable People at Events

John Pennington

Created and Managed 48 Billion Dollar Fund

Ryan Tseko

Executive VP for Grant Cardone Capital

Bridger Pennington

CEO of Fund Launch Live

Tim Ballard

CEO of O.U.R

LaVonne Idlette

Former US Team Olympian / Serial Entrepreneur

Joshua Diskin

Former Marin / Serial Entrepreneur

Built on Experience. Driven by Purpose.

Our leadership combines financial expertise with a mission to deliver consistent returns and real-world impact through asset-backed lending.

Eugene Nilus

Co-founder, Managing Partner

Chief of Lending

Karl Kulpak

Co-founder, Managing Partner

Chief of Investor Relationships

Frequently Asked Questions

Let's Make Sure This Investment Is Right For You

Schedule a quick free 30-minute consultation with us below

Y2 Capital Group Debt Fund 1, LLC

Powered by Y2 Lending

©2025 Y2 Lending, LLC - All rights reserved | 30 North Gould st #100, Sheridan WY 82801

Disclaimer

Investing in private securities, including the Y2 Capital Group Fixed Income Fund, involves risk and is intended for accredited investors only. Past performance is not indicative of future results. Returns are not guaranteed and may vary. All investments carry the risk of loss, including the potential loss of principal. This website does not constitute an offer to sell or a solicitation of an offer to buy any security. Any such offer will be made only through official offering documents and in compliance with applicable securities laws. Investors are strongly encouraged to consult with their financial, legal, and tax advisors before making any investment decisions.